Changing Trends in Numismatics

By Jeff Garrett

Looking at the most popular coins to collect over the years shows how collectors’ goals and aspirations continue to evolve.

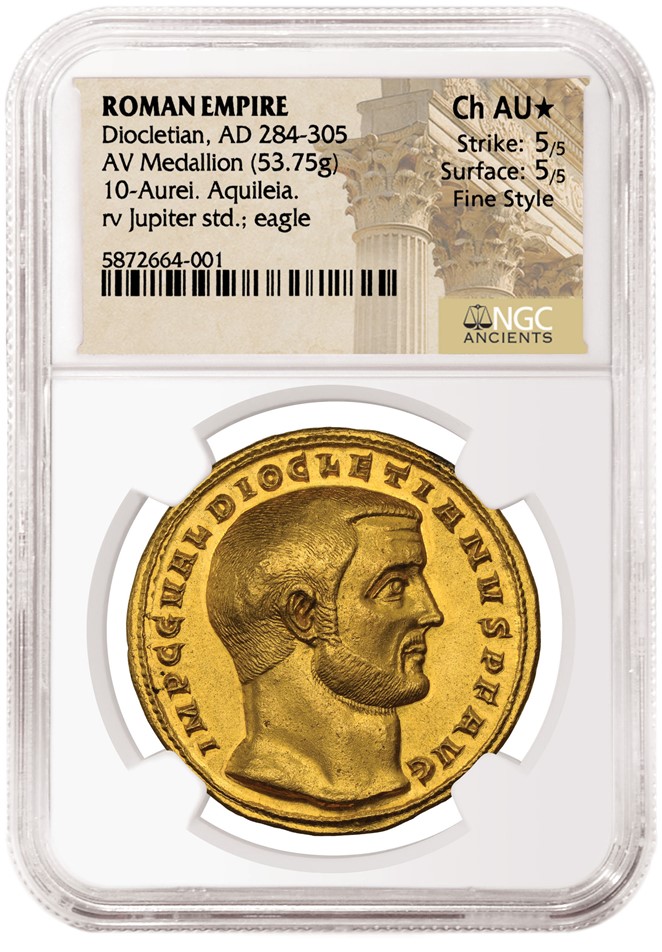

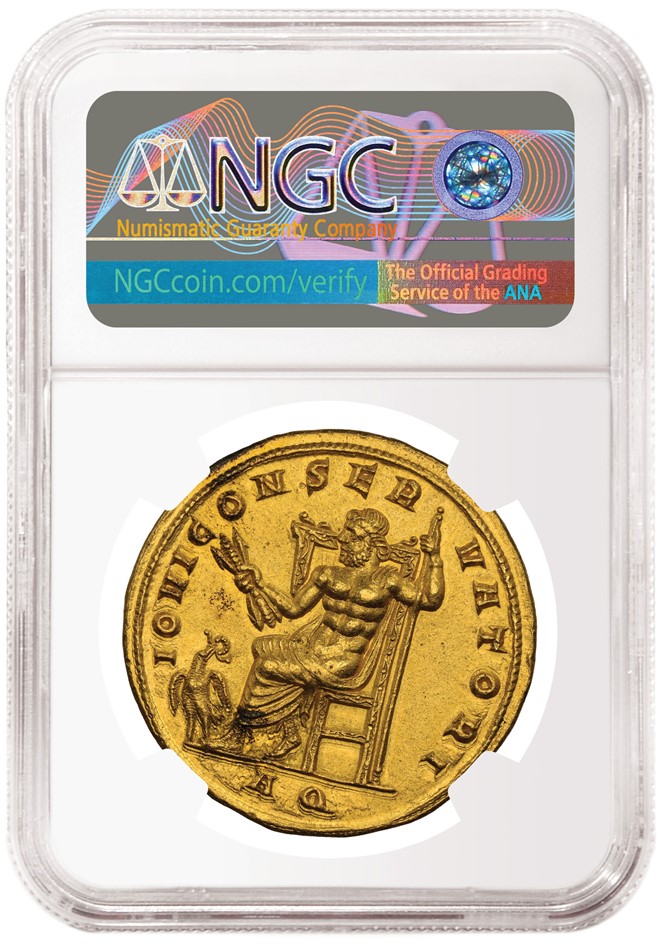

In recent years, the demand for rare coins in the top-end of the marketplace has soared. Multi-million-dollar hammer prices have become common place. Last night, an NGC-certified ancient coin sold to an American buyer for $1.9 million dollars. The most recent collecting trend that continues to amaze me has been the emergence of mega-rich collectors battling for the finest and rarest. There are at least four to six billionaires actively collecting coins, each of which has invested at least $200 million in their collection.

| |

| Roman Empire, Diocletian AD 284-305 Gold Medallion graded NGC Ancients Ch AU★, 5/5 Strike and 5/5 Surface with Fine Style. |

The buying activity of these mega-buyers has impacted prices for the finest known and important rarities. How long this trend continues is anyone’s guess. These buyers seem to be immune to the economic challenges facing average collectors — higher interest rates, inflation and falling equity markets. The entry of mega-collectors is just the most recent changing trend in numismatics.

Coin collecting habits in the US have evolved since the hobby became popular in the late 1850s. Large Cents became sought after when the large format was discontinued. Many great collections were formed by collectors who started to search for one of every year Large Cent struck from 1793 to 1857. Many were surprised to find out that none had been produced in 1815 due to a copper shortage. Early numismatists were also very interested in Colonial coinage and anything related to George Washington. A study of early rare coin auction catalogues can give today’s collectors an interesting glimpse of what was considered important to collect. Perhaps someday in the future collectors will find the habits of present-day collectors to be both interesting and amusing.

Many collectors today are also astounded that collecting coins by different mints did not become popular until the early 20th century. It was not until George Heaton published A Treatise on Coinage of the United States Branch Mints in 1893 that collectors took notice of Branch Mint coinage. This seems almost impossible to modern collectors who would pay $2 million for a 1927-D Double Eagle and only $2,000 for a 1927 Double Eagle. That tiny mintmark is worth a fortune!

Evidence that early collectors did not understand the value of coins from Branch Mints can be seen in the National Numismatic Collection in the Smithsonian. The core collection of the NNC came from the US Mint collection, which was started around 1838 by Chief Coiner, Adam Eckfeldt. The collection is extremely strong in early and later date Proof coinage, but it is lacking in most coins from the Branch Mints. The addition of the Lilly collection in the 1960s filled a tremendous gap in completing the gold coin collection of the NNC.

Other major collecting trends have developed over the years in American numismatics. In the 1960s, when silver was dropped from our circulating coinage, collectors became enamored by rolls of coinage and Proof sets. These were wildly popular in the 1960s, and a review of Coin World or the Numismatist from the time period is filled with ads selling these items. Many collectors of the time started out as speculators in BU rolls and Proof sets. It is interesting to note that during the 1960s the hobby boomed and many publications and organizations had their highest ever circulation and memberships. In the 1960s, ANA membership peaked at nearly 50,000 versus around 25,000 today.

When I first became a professional rare coin dealer in the late 1970s, gold and silver bullion became the driving force in numismatics. By the mid-1980s, common date gold coins dominated much of the action on the bourse floor. In 1984, a common date $5 Indian would sell for over $1,000 (around $2,500 in today’s dollars) if it was even close to Mint State. Rare coins were virtually ignored by most collectors at the time. Many of today’s numismatic fortunes that have been acquired by professional coin dealers have their roots in selling generic gold coins to collectors and investors.

The development of third-party grading changed the numismatic landscape dramatically in the mid-1980s. Rare coins had a degree of liquidity that had only been dreamed of before. Also, collectors could now have an idea of exactly how rare a coin is by examining the population reports. New investors’ money flooded the market and prices spiked going into the 1990s. As with any market that is fueled primarily by investors’ money, a bubble formed, and prices dropped drastically. Eventually, the market recovered, and today rare coin prices are primarily driven by collector demand. The advent of the internet has created huge numbers of serious collectors around the globe. The market for rare coins is now more transparent and liquid than ever before.

Because of several important factors, such as third-party grading and the internet, many new collecting trends have developed in the US. Collectors seem more focused than ever before on completing sets of different series. Many take this to extremes by paying “whatever it takes” to acquire coins that will make their sets the best of its kind. Prices realized at auction for coins that were once considered only appropriate to punch into a cardboard holder are truly astounding. Set registry collecting has fundamentally changed the landscape of numismatics.

My more recent experience with the popularity of modern coins has been formed by several collectors who have asked me to assemble sets for them. Another milestone in my journey learning about modern coins was co-authoring the book 100 Greatest Modern Coins with NGC Senior Grader, Scott Schechter. The book has been modeled after my extremely popular book, 100 Greatest United States Coins, produced by Whitman Publishing. Upon close inspection, there are dozens of very interesting and valuable coins struck after 1965. Many of these issues have great stories, which rival coins from an earlier era. The most appealing aspect of many of these coins is the affordability factor. Most of the coins in 100 Greatest United States Coins are worth six figures, if not millions. Many of the modern coins, however, are very affordable to the average collector.

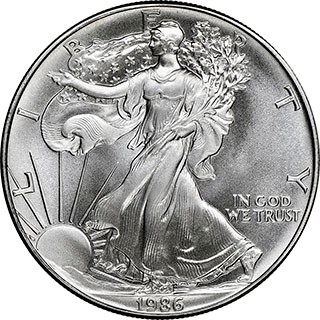

I would estimate that more individuals now collect Silver Eagles than just about any other series. Many of the largest, rare coin marketing firms in the country sell current issues of these in astounding numbers. Silver Eagles are considered to be the ideal “gateway” coin for introducing new collectors to numismatics. The coins are large, have high bullion content and are relatively inexpensive. Thousands of new collectors are brought into the hobby each month by purchasing Silver Eagles. The 2023 versions will be eagerly sought after when they hit the market.

Whatever your tastes are in numismatics, it is important to understand the history of this fascinating hobby. The next time you see a showcase of amazing vintage coins right next to a case of modern issues you will have a better understanding of why collectors have such varied interests.

The rare coin market will continue to evolve, and savvy collectors should try to avoid red hot markets and look for emerging trends and opportunities.

As always, the best advice is to find a series you enjoy and try to learn as much as possible. This advice will serve you well whether you collect Morgan Silver Dollars or American Silver Eagles.

.

.

Leave a Reply